How To Check FAB Bank Balance Online?

Do you own a bank account with First Abu Dhabi Bank (FAB)? Do you want to know your account balance but don’t want to go through the hassle of physically going to the branch?

Don’t worry because you can easily check your FAB bank balance online, including your FAB Bank Salary account balance check online is possible.

In this article, we’ll show you the FAB bank balance check online full process, so you can quickly and easily check your account balance without leaving the comfort of your home. Let you know, with the same process you can also check your Rabiti card salary. As Rabiti Card is also linked to your FAB bank account.

FAB Bank Balance Check Online Full Process

FAB Bank is one of the leading banks in the UAE, offering its customers a wide range of banking products and services.

One of the most convenient services offered by FAB is the ability to do a Fab balance check online, anytime.

There are two ways you can check your FAB bank balance online:

Let’s take a look at each method in detail.

How To Check FAB Bank Balance Online via the Official Website?

This is the most straightforward method to FAB bank balance check online. All you need is a mobile or computer with an internet connection and a FAB prepaid card.

Here’s the step-by-step guide on how to check your FAB bank balance online via the official website:

1. Go to the Official FAB Website Balance Check Page

Link Here: https://ppc.bankfab.com/PPCInquiry/

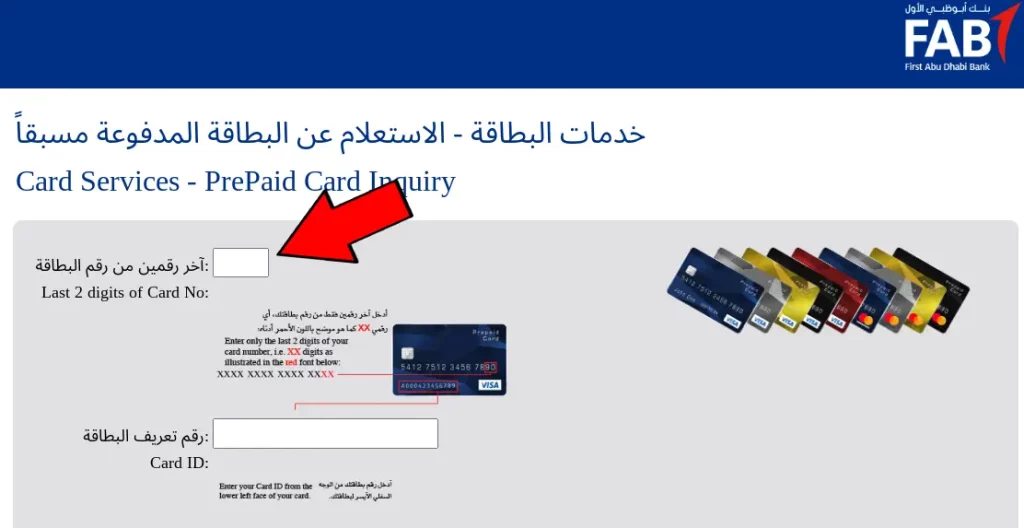

2. Fill in The Last Two Digit Of the Card Number

Once you land on the official site of FAB, you’ll see the blank box where you need to fill in the last two digits of your prepaid card number.

Your prepaid card number is your 16-digit FAB account number. However, in this box, you only need to enter the last two digits.

3. Fill in The Card ID In The Second Box

You need to fill in your Ratibi card ID in the second box. If you don’t know where to find your card ID, it’s the 13-digit number printed on the front side of your card at the lower left corner.

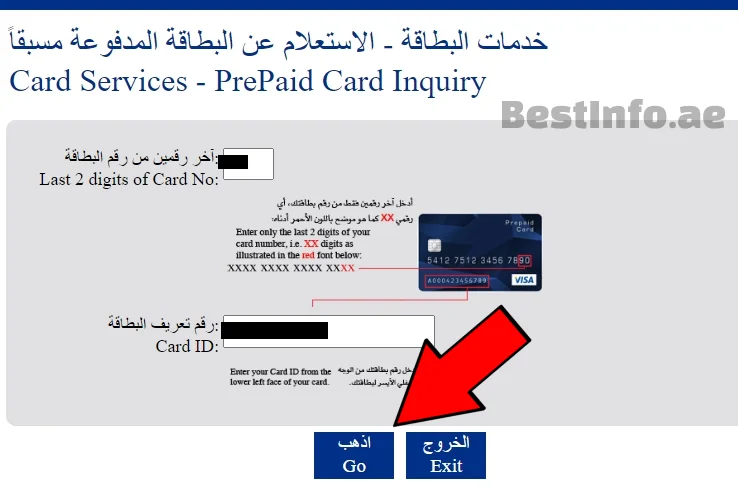

4. Click On Go Button

After you enter both the required information, you must click on the “GO” button, and your FAB bank balance will appear on the screen within a few seconds.

Along with the FAB bank balance, you’ll also see the last 10 transactions, including the date and amount of each transaction.

This is how you can complete the FAB balance enquiry and do the FAB bank salary account balance check easily at home.

Checking FAB Bank Balance Online Through the Mobile App

This is the second method to check your FAB bank balance online. The only difference is that instead of using a computer, you’ll be using the FAB mobile app, which is available for both Android and iOS devices.

Here’s the step-by-step guide on how to check your FAB bank balance online through the mobile app:

1. Download and Install the FAB Mobile App

If you don’t already have the app, you can download it from the Google Play Store for Android devices or the App Store for iOS devices.

2. Sign in or Sign up for an Account

Once you open the app, you’ll be prompted to sign in or sign up for a new account. If you already have an account, sign in with the required information.

If you don’t have an account yet, click on the “Sign up” button and follow the steps:

- Enter your customer ID or Debit card number

- Enter the split password sent to your mobile number or registered email address

- Create a 6-digit pin

- You’re ready to use the app

3. Check Your Bank Balance

Once you log in to your account, you’ll clearly see your bank balance on the home page with the savings account number.

You can also explore the app to see other features, such as transferring money, paying bills, and more.

Alternate Option to Check Your FAB Bank Balance – FAB ATM Balance Check

In case you don’t have an internet connection or you’re facing some technical issue while checking your bank balance online, there’s an alternate method through which you can easily check your account balance.

You can simply reach out to the nearest ATM and check your bank balance without any issues. Just insert your ATM card into the machine, enter your PIN, and you’ll be able to see options such as Withdraw Money, Check Balance’ and more.

Click on the “Check Balance” option, and your current bank balance will appear on the screen.

The only downside of this method is finding a working ATM machine and reaching there physically. So, it’s not the most convenient option, but it still works if you’re in an emergency situation or the ATM is located near you.

That’s it! These are the three methods, including 2 online, to easily check your FAB bank balance online. Let’s now learn more related details about FAB.

How To Check FAB Bank Salary Account Balance?

You can easily open a salary account with FAB and get started if you’re a salaried individual. Once you have your salary account, you can do FAB Bank salary account balance check using any of the methods we’ve mentioned above.

You can use the online portal, mobile app, or ATM. The steps are exactly the same, you just need to ensure you’re using the right credentials to log in to your account and do the FAB Atm balance check.

About FAB Bank

FAB (First Abu Dhabi Bank) is a United Arab Emirates (UAE) based bank that was established in April 2017 following the merger of the National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB).

By merging the two banks, FAB became the largest bank in the UAE. Its logo is FAB which features “Awwal” (the Arabic word for “first”), which represents growth and leadership.

Also note that the FAB bank is available digitally, on which you can open an account, transfer money, check your balance, apply for any card, and much more. The best of being digital is they are available 24/7 and be used on their app and website.

Sitting in your comfort, you can manage your money with FAB bank and open any bank account, including saving and checking.

Lastly, the best part of this bank is that it has no monthly maintenance fees and offers a wide range of fee-free services. Even they don’t have minimum balance requirements criteria.

FAB / NBAD Bank Prepaid Cards

If you’re confused between FAB and NBAD bank cards, first know that NBAD is now merged with FAB, forming the First Abu Dhabi Bank. So either we talk NBAD or FAB cards, it’s the same thing.

The best of using these cards is that they offer great value for money and are much safer than carrying cash.

Plus, these cards can be used in millions of places worldwide, including ATMs, restaurants, hotels, and online.

They offer both credit and debit cards, however, each with its own benefits and features. For example, the debit card offers free cash withdrawals at any FAB ATM, while the credit card comes with a host of rewards and discounts.

You can load funds onto these cards and use them anywhere that accepts Visa or Mastercard. Also, you can transfer money from your account to another.

Rabiti Card Features & Benefits

The Rabiti prepaid card is a great way to manage your money and comes with some great features:

- Free to use

- Any UAE residents can apply for this card

- No minimum balance requirements

- No monthly fees

- Can be used in millions of places around the world

- Offers both credit and debit card options

- Get free cash withdrawals at any FAB ATM

- Enjoy a host of rewards and discounts with the credit card option

- You can get a salary payment once a month

- The salary you have accrued will be deposited into your bank account via bank transfer.

- You can also use this card for online shopping and make bill payments

- You can spend AED 1,500 per month on shopping and AED 2,500 per month on bill payments.

FAB Cashback Offers

FAB bank offers a great way to save money with its cashback program. With this program, you can earn cashback on your everyday spending.

To participate in this program, use your FAB credit or debit card for all of your purchases and receive the salary in that account. Then, at the end of each month, you’ll receive a statement showing how much cashback you’ve earned.

However, the cashback limit amount is different for UAE residents and foreigners. For UAE residents, they have a limit of AED 5,000 per month, while for foreigners, the limit is AED 2,500 per month.

For UAE Residents:

- If your salary is AED 5,000 to AED 25,000, you’ll earn 3% cashback. This will be between 150 to 750 AED.

- If your salary is AED 25,000 to AED 50,000, you’ll earn 4% cashback. This will be between 1,000 to 2,000 AED.

- If your salary is more than AED 50,000, you’ll earn 10% cashback. This will be a maximum of 5000 AED.

For Foreigners:

- If your salary is AED 5,000 to AED 25,000, you’ll earn 2.5% cashback. This will be between 125 to 625 AED.

- If your salary is AED 25,000 to AED 50,000, you’ll earn 3% cashback. This will be between 750 to 1,500 AED.

- If your salary is more than AED 50,000, you’ll earn 5% cashback. This will be a maximum of 2500.

You’ll get the cashback deposited into your account on a monthly basis. So start using your FAB card for your purchases and save today.

FAQ’s

Can I check the Salary on my Mobile?

Answer: Yes, you can easily check your salary on the mobile app. You need to install the official app of FAB on your mobile phone and log in using the required credentials. Once you’re logged in, you can clearly see your salary on the homepage.

How can I get a FAB Prepaid Ratibi card?

Answer: Getting a FAB Prepaid Ratibi card is very easy if you’re eligible for it. The list of its eligibility criteria includes you must have a corporate account in FAB bank, the employee must be a resident of the UAE, and employees with complete and up-to-date KYC required documents.

How do I check my FAB balance?

Answer: There are multiple ways through which you do a FAB Bank balance check online or offline. You can use the online portal, mobile app, or ATM. All of these methods are very simple and easy to use. Just make sure you’re using the right credentials to log in to your account.

What is the minimum balance in Fab?

Answer: There’s no minimum balance requirement in FAB bank. You can open an account with any amount you want, and there are no penalties or fees for not maintaining a minimum balance.

What are the eligibility criteria for FAB / NBAD prepaid cards?

Answer: To be eligible for a FAB / NBAD prepaid card, you must be a UAE resident with complete KYC documentation. You can open an account in FAB (First Abu Dhabi Bank) and apply for a prepaid card.

Conclusion

That’s all you need to know about how you can check FAB bank balance online. We hope this guide was helpful and you can check your bank balance without any issues.

We’ve also mentioned an alternate method to do FAB ATM Balance Check in case you face any issues while checking it online.

If you have any questions or suggestions, feel free to reach out to us in the comment section below, and we’ll get back to you as soon as possible.